Gezamenlijk bericht van Nutreco en SHV.

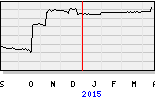

Amersfoort / Utrecht, the Netherlands, 25 March 2015 - Nutreco N.V. ("Nutreco") and SHV Investments Ltd. (the "Offeror"), an indirect wholly owned subsidiary of SHV Holdings N.V. ("SHV"), are pleased to announce that during the post-closing acceptance period (na-aanmeldingstermijn) that ended on 25 March 2015 at 17:40 hours, CET, (the "Post-Closing Acceptance Period"), 1,524,854 issued and outstanding ordinary shares in the capital of Nutreco were tendered for acceptance under the Offeror's recommended cash offer to all holders of issued and outstanding ordinary shares in the capital of Nutreco (the "Shares") to acquire their Shares (the "Offer").

Acceptance

The 1,524,854 Shares tendered under the Offer during the Post-Closing Acceptance Period (the "PCAP Shares") represent approximately 2.17% of the issued share capital of Nutreco, approximately 2.27% of the issued and outstanding share capital of Nutreco, and an aggregate value of approximately EUR 68,999,643.5 (at an Offer Price of EUR 45.25 (cum dividend) in cash per Share).

The 19,470,145 Shares held indirectly by SHV on 10 March 2015 together with (i) the 45,081,713 Shares tendered under the Offer during the Offer Period that ended on 10 March 2015 at 17.40 hours, CET, and (ii) the 1,524,854 PCAP Shares, amount to a total of 66,076,712 Shares, represent approximately 94.08% of the issued share capital of Nutreco, approximately 98.42%% of the issued and outstanding share capital of Nutreco, and an aggregate value of approximately EUR 2,989,971,218 (at an Offer Price of EUR 45.25 (cum dividend) in cash per Share).

Settlement

With reference to the Offer Memorandum and the Offeror's press release dated 30 January 2015, Shareholders who accepted the Offer shall receive an amount in cash of EUR 45.25 (cum dividend) (the "Offer Price") for each Share validly tendered (or defectively tendered, provided that such defect has been waived by the Offeror) and transferred (geleverd) for acceptance pursuant to the Offer, under the terms and conditions of the Offer and subject to its restrictions.

Payment of the Offer Price per Share for the PCAP Shares that were validly tendered (or defectively tendered provided that such defect has been waived by the Offeror) during the Post-Closing Acceptance Period shall occur as soon as reasonably possible and in any case no later than the fifth (5th) Business Day following the day on which such PCAP Shares were tendered.

Delisting

As announced by Nutreco and the Offeror on 18 March 2015, delisting will take place on 17 April 2015 and the last day that the Shares can be traded on Euronext will therefore be 16 April 2015.

Further consequences of the Offer

The Offeror intends to initiate a squeeze-out procedure in an expeditious manner. Reference is made to paragraph 6.13(a) (Compulsory acquisition procedure) of the Offer Memorandum.

Announcements

Any further announcements in relation to the Offer will be issued by press release. Subject to any applicable requirements of the applicable rules and without limiting the manner in which the Offeror may choose to make any public announcement, the Offeror will have no obligation to communicate any public announcement other than as described above.

Further information

This announcement contains selected, condensed information regarding the Offer and does not replace the Offer Memorandum. The information in this announcement is not complete and additional information is contained in the Offer Memorandum.

A digital copy of the Offer Memorandum is available on the websites of Nutreco (www.nutreco.com) and SHV (www.shv.nl). Copies of the Offer Memorandum are also available free of charge at the offices of Nutreco, SHV and the Paying and Exchange Agent, who distributes the Offer Memorandum on behalf of the Offeror, at the addresses mentioned below. The SHV and Nutreco websites do not constitute a part of, and are not incorporated by reference into, the Offer Memorandum.

The Paying and Exchange Agent

ABN AMRO Bank N.V.

Corporate Broking Department HQ7050

Gustav Mahlerlaan 10

1082 PP Amsterdam

The Netherlands