Amsterdam, the Netherlands - Royal Philips (NYSE: PHG; AEX: PHIA), a global leader in health technology, today announced that it has signed an agreement to acquire EPD Solutions, an innovator in image-guided procedures for cardiac arrhythmias (heart rhythm disorders). EPD’s cardiac imaging and navigation system [1] helps electrophysiologists navigate the heart by generating a detailed 3D image of the cardiac anatomy, while also pinpointing the location and orientation of catheters during the diagnostic and therapeutic procedures for cardiac arrhythmias. This breakthrough technology has the potential to simplify navigation and treatment, immediately assess the treatment result and ultimately enhance procedure efficacy.

The acquisition will complement Philips’ portfolio of interventional imaging systems, smart catheters, planning and navigation software, and services, and will allow the company to introduce new solutions in the EUR 2+ billion market [2] for image-guided treatment of cardiac arrhythmias, which is growing at a double-digit rate. Philips will acquire EPD for an upfront cash consideration of EUR 250 million and deferred, milestone dependent payments. In connection with these contingent payments, the company expects to recognize a provision of approximately EUR 210 million [3] upon completion of the transaction. The transaction, which is subject to customary closing conditions, is expected to be completed in July, 2018.

“EPD’s breakthrough innovation provides detailed 3D anatomical information of the heart during cardiac arrhythmia ablation procedures that is unique in the industry,” said Frans van Houten, CEO of Royal Philips. “The technology has the potential to address the key unmet need of real-time therapy assessment, which is one of the more significant limitations of the current standard of care. This acquisition will strengthen our ability to improve the lives of arrhythmia patients, and is entirely consistent with our strategic plan to broaden our image-guided therapy solutions portfolio and drive long-term profitable growth for Philips.”

“I am very pleased that Philips will become the home for our innovation, our business and our people,” said Professor Shlomo Ben-Haim, Founder and Chairman of EPD Solutions. “Philips’ expertise and leadership in interventional imaging and navigation is an excellent strategic fit with EPD. I am convinced that as part of Philips, we will be able to grow EPD and help many electrophysiologists and patients worldwide, as we aim to reduce procedure costs, simplify navigation and treatment, and ultimately improve procedure efficacy.”

The combination of Philips’ interventional imaging systems, such as Azurion, and EPD’s cardiac imaging and navigation system provides the maps and data used by electrophysiologists to guide various catheters to locate and treat cardiac arrhythmias. EPD’s system, which obtained CE marking in February, 2018, is based on proprietary software algorithms and single-use electromagnetic sensors, used in conjunction with standard electrophysiology catheters. The system has been installed at several leading hospitals across Europe. The premarket notification (510(k)) for the system for imaging and navigation during arrhythmia ablation procedures is currently under review by the US FDA.

Upon completion of the transaction, EPD and its employees will become part of Philips’ Image-Guided Therapy business. Professor Shlomo Ben-Haim, who has a proven track record in building successful medical device businesses, will continue to support Philips to build a new business based on this acquisition.

[1] EPD’s cardiac imaging and navigation system is not available for sale in the US.

[2] Addressable market for Philips. Following the acquisition of EPD, Philips’ total addressable Image-Guided Therapy market is EUR 8+ billion.

[3] Estimated fair value of the contingent payments.

Philips announces exchange ratio for 2017 dividend in shares

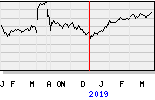

Amsterdam, the Netherlands – Royal Philips (NYSE: PHG, AEX: PHIA) (NYSE: PHG, AEX: PHIA) today announced that the exchange ratio for the dividend in shares for the year 2017 has been determined. The exchange ratio is 1 new common share for every 44.2563 existing common shares. This ratio was based on the volume weighted average price on Euronext Amsterdam of May 30 and 31, and June 1, 2018, of EUR 35.3750 and was calculated in a manner that the gross dividend in shares is approximately equal to the gross dividend in cash.

Shareholders were given the opportunity to make their choice between cash and shares between May 9, 2018 and June 1, 2018. If no choice was made during this election period, the dividend will be paid in cash. Both the dividend in cash and the dividend in shares will be made payable to shareholders from June 6, 2018.

On the dividend record date, May 8, 2018 the total number of common shares outstanding, after deduction of treasury shares was 922,390,075 shares (2017: 927,486,796 shares). For 45.7% of the shares, an election was made for a share dividend, resulting in the issuance of 9,533,223 new common shares (2017: 48.3% and 11,264,163 new common shares, respectively).