•2013 FY EBITDA substantially up to €1,314 million (2012 FY: €1,109 million)

•Q4 2013 EBITDA €316 million (Q4 2012: €243 million)

•Strong cash generation from operating activities of €889 million in 2013 (2012: €730 million)

•Dividend increase of 10% proposed to €1.65 per ordinary share (2012: €1.50)

•Share repurchase program to hedge existing option plans continues

•Target for 2014 to improve business performance to at least offset negative currency impact

Royal DSM, the Life Sciences and Materials Sciences company, today reported final, audited, results for 2013. These results confirm the preliminary, unaudited results DSM published on 21 January 2014. DSM today also issues its Integrated Annual Report.

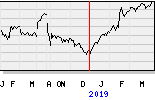

For the full year 2013, DSM delivered 18% higher EBITDA, while facing a challenging economic environment. For Q4 the company realized 30% higher EBITDA.

In Q4 all clusters delivered a solid performance despite negative exchange rate effects. Nutrition was in addition impacted by a combination of unrelated market headwinds. These included weakness in dietary supplements and fish oil based Omega 3 markets in the US, soft demand in Western food & beverage markets, and price pressures especially in vitamin E following weak demand in animal feed markets earlier in the year. DSM previously signaled these adverse conditions, but the impact through the end of the year was more pronounced than anticipated.

Due to the transaction announced with JLL Partners, DSM Pharmaceutical Products has been classified as Asset held for Sale and discontinued operations.

Commenting on these results, Feike Sijbesma, CEO/Chairman of the DSM Managing Board, said: “We achieved significant strategic progress in 2013, also demonstrated by an 18% increase in full year EBITDA and strong cash generation. We were pleased with the strong performance in Materials Sciences in Q4. Despite the moderate Q4 results in Nutrition, due to currencies and market weakness, DSM’s market positions remained strong. This business with its broad, global offering across the value chain is well positioned to benefit from the structural megatrends, with the need to nourish a growing and aging global population, living increasingly in urban areas, paying more attention to health and well-being. This will continue to drive increased demand for nutritional ingredients.

We remain firmly on track to deliver on our strategy and to create sustainable value with all our clusters. Therefore we propose a dividend increase of 10%. In the short term our focus will continue on the operational performance of our businesses, supported by our Profit Improvement Program and intensified R&D and innovation programs.”

zie meer op

www.dsm.com