ABN AMRO reports net profit of EUR 693 million for Q2 2019

•Net profit for the second quarter strong at EUR 693 million, reflecting solid operational performance and moderate impairments

•Cost/income ratio for the first half year was 59.9%, return on equity 11.4%

•Result included a EUR 114 million provision (pre-tax) for a customer due diligence remediation programme at Retail Banking

•Strong capital position with a CET1 ratio of 18.0%, excluding half-year profit

•Interim dividend has been set at EUR 0.60 per share, 50% of half-year profit

•We remain focused on our targets in a challenging environment

Kees van Dijkhuizen, CEO, comments:

‘We are making good progress in further embedding our strategy, which has a key focus on sustainability. We were therefore very pleased that ABN AMRO was named Western Europe’s Best Bank for Sustainable Finance by Euromoney. In the second quarter, our mortgage market share improved to 17% from 14% while maintaining pricing discipline. We expect the improvement in our market share to continue in the next quarter.

We posted a strong net profit of EUR 693 million, reflecting higher net interest income, some one-offs including the sale of Stater and a provision for a customer due diligence (CDD) remediation programme at Retail Banking, and moderate impairments. Return on equity for the quarter was 13.6%; if regulatory levies were to be divided equally over the year, return on equity would have been 12.5%.

We welcome the plans of the Dutch government to jointly combat financial crime and achieve broader cooperation between banks, law enforcement and regulators on both a national and European level. After our announcement at Q4 on detecting financial crime, we centralised and bolstered our CDD activities. More than 1,000 people are currently fully committed to this, and this number will increase substantially in the next few years. Recently, the Dutch central bank (DNB) determined that we are to review all our retail clients in the Netherlands. Consequently, we will undertake further measures and extend our CDD remediation programme, for which we have made an additional provision of EUR 114 million. In general, across the bank we will take all remedial actions necessary to ensure full compliance with legislation. Sanctions, such as an instruction, fines, may be imposed by the authorities.

The regulator is focusing on capital regulation and we expect further regulatory impact going forward. Our capital management reflects the current economic and regulatory outlook as well as our approach to sustainable dividends. Our capital position remains strong. The Basel IV CET1 ratio remained largely unchanged compared with year-end 2018, excluding the half-year profit for 2019. The interim dividend has been set at EUR 0.60 per share, a pay-out of 50% of half-year profit, which is in line with last year. We are within the capital target range and expect to be well placed to consider additional distributions of above 50% of profit at year-end.

Interest rates continued to come down in the last quarter, predominantly impacting deposit margins. We are taking action by focusing on margins, developing revenue opportunities and strict cost discipline. We remain focused on our targets in a challenging environment.’

see & read more on

https://www.abnamro.com/en/images/Documents/035_Social_Newsroom/Press_Releases/2019/ABN_AMRO_Press_Release_Q2-results_2019.pdf

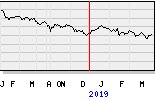

ABN AMRO tijd 09.13

laat ook een verlies zien op EUR 15,795 -76ct vol. 682.000